MyPass® featured in a recent report by NERA that shows the potential of Australia’s oil & gas industry to generate up to $49 billion for the economy by 2030.

They believe the key to unlocking this economic growth is tapping into the existing domestic supply chain that has “not yet reached its full potential.” The report, ‘Growing Australia’s Oil & Gas Supply Chain 2020′, shows where the supply chain is currently falling short, where the areas of opportunity are and how through collaboration, each can be addressed.

MyPass® & NERA

MyPass® has been a partner of the National Energy Resources Association over the past four years. During this time, we’ve received support to aid our growth as an emerging Australian technology solution that is specifically addressing issues in this supply chain. Building a streamlined, integrated supply chain is at the heart of MyPass® Global’s vision to redefine the way Australia’s resource industry works. Oil & gas are an essential sector within this industry with which we’ve been able to build strong partnerships.

The role of SME’s

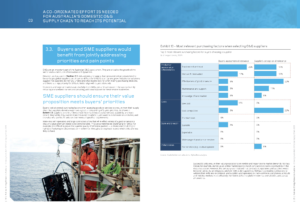

The report refers to the opportunity for SME’s to be “nimble and respond to market demands” in a way that large corporations cannot do. This means that SME’s can better align with buyer demands within the supply chain.

Here it refers to MyPass® as a case study in which we were able to pivot our value proposition based on the industry benefits rather than a single stakeholder. As a result, we moved from only servicing contractors to expanding our platform so that workers, contractors, asset owners and training organisations could integrate with one another in the supply chain.

The impact of this has been the creation of an eco-system in which a centralised dataset acts as a single source of truth for all stakeholders, rather than each working in isolation from one another.

Report findings

The report states that in 2016-17 Australia’s oil & gas supply chain was valued at $38 billion. This is approximately 1.2 times the size of the building construction sector and NERA believe it can bring more than $10B extra value to the economy. The three main challenges listed for the oil & gas supply chain include:

- A limited focus on local work that requires low levels of technical expertise, making it unlikely to be exported

- High costs lower the potential for exporting by suppliers and increase the difficulty for operators to invest

- The global and complex nature of the oil & gas industry makes it difficult for small-medium sized suppliers to succeed

Due to these challenges, the report suggests that a stronger more innovative supply chain yield up to $7B more by 2030 than if it continued as it is. The recommendations for change include:

- Suppliers deepen areas of strength to develop more advanced offerings which would make them more competitive globally

- Operators, large contractors, government and research organisations offer more support for local innovation to lower costs and improve productivity

- SME’s to expand their understanding of buyers’ priorities and at the same time buyers create new pathways for procurement of SME’s that mitigate current barriers.

To learn more about how MyPass is changing the way supply chains work, book a demo.